Integral Money: Beyond King Dollar - Navigating the Evolution

The evolution of the global reserve currency, appears to be accelerating. As China, Russia, Saudi Arabia, and Iran continue to create closer trading ties and President Xi Jinping continues to call for and develop a system to exchange and trade oil and gold in the Yuan, the end of the petrodollar is potentially nigh and a multi polar global reserve system may soon become a reality sooner than most consider, if they consider it at all.

We may be, in my view, in the end game for the US Dollar as the principal central global reserve currency. Its demise would prove to be the catalyst for great change in many areas and senior Executives will have to be ready for what may come.

Why should you care? Because this could change everything, who leads, how we govern, how we work and live and what business models work, how we save and plan for the future. How do we know this, because at each evolutionary transition in history - it usually has!

These evolutions take many years to play out and then seem to happen all at once. To comprehend this complex evolution, it is crucial to look from multiple perspectives and use some helpful maps of the territory. In this blog (part of my Integral Money series), we will continue to look at the transformation of money using Integral Theory and Spiral Dynamics as guiding frameworks. These maps provide a comprehensive understanding of, amongst other things, the multi-faceted nature of monetary development, enabling us to analyse and understand each stage in-depth and see more clearly where we may be headed.

Understanding the stages of evolution

Spiral Dynamics, a frame uncovered by Clare Graves and developed by Don Beck and Chris Cowan, is a powerful tool for understanding the various stages of societal development. It identifies eight stages (colour coded for ease) that reflect different worldviews and values. Ken Wilber’s Integral Theory has similar vertical levels of development in its framework. By applying these frameworks to the evolution of money, we can appreciate the shifts in the global monetary system and identify crucial patterns that have emerged over time. I covered these stages in more detail in my earlier blog from 2019 but I summarise here for ease.

Beige (Survival): Barter Systems

The earliest stage of monetary evolution aligns with the beige, characterised by basic survival needs. Here, primitive barter systems took shape as individuals exchanged goods and services to meet their immediate needs. Money had not yet emerged as a separate entity, but the concept of exchange laid the groundwork for its eventual development.

Purple (Tribalism): Commodity Money

As societies progressed to the purple stage, people began to organise into tribes and communities. This stage gave rise to commodity money, where items with intrinsic value (such as cattle, salt, gold nuggets, grains, or shells) were used as a means of exchange. These commodities served as a unifying factor, strengthening tribal identity and cohesion while addressing some of the limitations of the barter system.

Red (Power): Metal Coins

The red stage, characterised by power dynamics and dominance, led to the emergence of metal coins as a form of currency. This transition was driven by the need for a more standardised and durable means of exchange. Coins, usually made of gold, silver, or bronze, became a symbol of power for rulers and their empires. The use of coins facilitated trade and economic growth, solidifying the role of currency in human society.

Amber/Blue (Order): Banknotes and Centralised Banking

The blue stage, focused on order and stability, gave rise to banknotes and centralised banking structures and standards. This stage marked the beginning of modern monetary systems, as banknotes often backed by gold or silver, provided a more practical and portable form of currency. Central banks were established to regulate and manage the money supply, fostering trust and promoting economic stability.

Orange (Achievement): Electronic Money, Fiat and Globalisation

In the Orange stage, characterised by individualism and achievement, we witnessed significant developments in the global monetary system. This stage saw the rise of electronic money, the globalisation of financial markets. The role of technology in this stage cannot be understated, as advancements facilitated wire transfers and digital banking, increasing the efficiency and convenience of monetary transactions. Globalisation interconnected financial markets and led to the rise of powerful multinational corporations, creating a competitive, profit-driven global economy.

Most importantly, the orange stage saw the rise of a fiat reserve currency. In 1971, President Nixon "temporarily suspended" the gold convertibility of the US dollar, effectively making the world's reserve currency fiat, backed only by decree.

This shift led to the establishment of the "petrodollar" system, where Saudi Arabia agreed to price its vast oil supply in US dollars, creating global demand for the currency. In return, the US provided military support to Saudi Arabia. However, this arrangement may be on the verge of change as Saudi Arabia and China strengthen their trade relations and grow closer.

Interestingly, many recent kinetic conflicts have ignited when countries sought to price or trade their oil in currencies other than US dollars, despite other reasons being cited in the mainstream narrative.

The introduction of fiat reserve currency diluted the store-of-value aspect of money, enabling central banks to create unlimited amounts of money with the press of a button. This development resulted in inflation and the erosion of buying power per unit of currency over time. The "exorbitant privilege" of money creation allowed the currency creator to live well beyond its means, incentivising others to seek similar benefits.

As certain countries were cut out of the US Swift system, trading partners like Russia and Iran accelerated their move to create ties with China and its alternate systems. Saudi Arabia has grown closer to these trading partners, with China & Iran becoming a more significant client and the US focusing more on its domestic oil production. This shift could potentially accelerate the transition towards a multipolar reserve currency system.

Central Bank Digital Currencies (CBDCs), in many ways, represent an Orange, centralised version of cryptocurrencies, lacking the evolutionary distributed nature of the green level exemplified by Bitcoin. Many crypto tokens that have experienced pump-and-dump schemes are also orange imitations of the Green stage. While these tokens may have their use cases, the benefits ultimately serve the centralised creator rather than the community as a whole.

Green (Community): Decentralisation and distributed networks

In the Green stage, values shift towards a world-centric focus on community and equality. This shift gives rise to cryptocurrencies and decentralized financial systems, emphasising the democratisation of access to financial resources. True distributed network cryptocurrencies like Bitcoin emerge as alternatives to traditional monetary systems.

These digital currencies operate on distributed networks, such as the blockchain, offering increased transparency and security while reducing reliance on centralised authorities. In a post-truth world where trust is scarce, Bitcoin's robustly verifiable ledger, backed by the proof-of-work power projection system, presents a unique solution.

Nation states, central banks, and the current global reserve provider are currently overtly fighting against this movement. However, due to the distributed and decentralised nature of cryptocurrencies like Bitcoin, efforts to ban and contain them have proven difficult.

US Space Force Major Jason P. Lowery presents a compelling argument in his MIT thesis, "Softwar." He suggests that instead of banning Bitcoin, the US should embrace it as a means of defence in the cyber world. Rather than relying on the Orange stage's mutually assured destruction through nuclear weapons as a means of power projection, Bitcoin could provide a route to mutual assured preservation. This concept would incentivise parties to preserve the distributed information ledger system and protect one another instead of seeking mutual destruction.

The Green stage highlights the potential for cryptocurrencies and decentralised financial systems to reshape our understanding of global monetary systems. By embracing these new technologies and the values they embody, there is potential for a more inclusive and secure financial future.

4 Quadrants of Integral Wellbeing

Future Directions: Anticipating the Future Stages of Monetary Evolution

Even though the evolution from orange to green is yet to fully play out, we can look towards the future. It is crucial for C-Suite executives to stay ahead of the curve by understanding the potential trajectories of the global monetary system and its risks, opportunities, and implications. Drawing from the insights provided by Integral Theory and Spiral Dynamics, we may anticipate the next stage of monetary evolution and prepare for the challenges and opportunities it presents.

You may recall that the principal blind spot for each of the first six levels of the vertical evolution described earlier, is that each level believe they are right, and the others are wrong! I advocate that the answer is often an “and” rather than an “or”.

Teal/Yellow (Integration): Integral Financial Systems

The yellow stage, characterised by a focus on integrating multiple perspectives and addressing global challenges, could give rise to more holistic and inclusive financial systems. We may see the development of integral hybrid currencies that combine the benefits and resilience of traditional and digital money, as well as innovative financial tools that promote sustainability, social impact, and responsible investment.

Turquoise (Holistic Consciousness): Global Collaboration and Redefining Wealth

As societies move towards the turquoise stage, global collaboration, and a deeper understanding of the interconnectedness of all aspects of life will become central themes. The monetary system may evolve to reflect these values, with a stronger emphasis on reducing the inequity of economic imbalances, promoting systemic resource distribution, and redefining wealth beyond material accumulation.

Looking from other perspectives

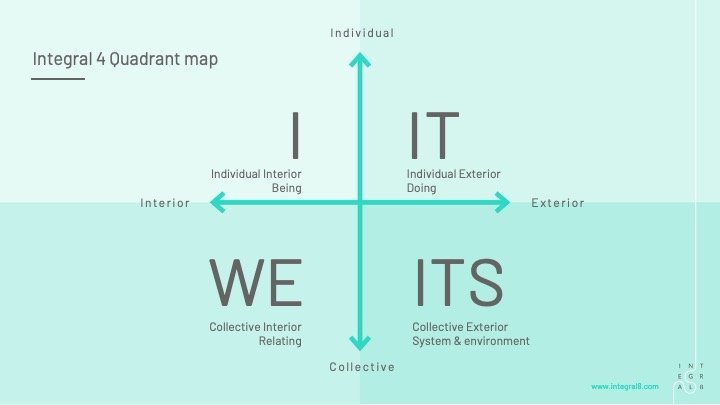

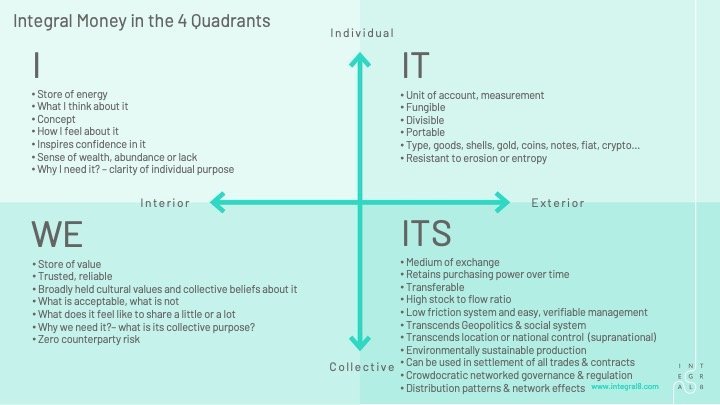

Ken Wilber's Integral Theory offers a comprehensive framework for understanding the complex nature of the global monetary system. As well as utilising a similar vertical structure as described above it also integrates four principal perspectives (quadrants) in a separate map. With the 4 Quadrants – interior-individual (“I” intention), exterior-individual (“IT” behaviour), interior-collective (“WE” culture), and exterior-collective (“ITS” systems) – we can examine the evolution of money holistically (I covered this in more detail in an earlier 2020 blog and summarise here for ease)

I- Interior-Individual (Intention):

As people's values and worldviews evolved through each stage identified above, their perception of money and its purpose are also transformed. From basic survival needs to power dynamics and global interconnectedness, the intention behind monetary transactions and our beliefs and feelings related to money shift significantly.

IT-Exterior-Individual (Behaviour):

Technological advancements, such as the invention of coins, banknotes, and electronic money, influenced how individuals interacted with currency. As each new form of money emerged, individual behaviours adapted to incorporate these innovations.

We- Interior-Collective (Culture):

Money played a significant role in shaping societal structures, from tribes to empires and multinational corporations. The cultural values of each stage were reflected in the evolution of the monetary system, fostering collective identity and shared beliefs about the nature of wealth and power.

ITS- Exterior-Collective (Systems):

The evolution of money gave rise to complex financial systems, including centralised banks, global financial markets, and decentralised cryptocurrencies. These systems shaped the economic landscape, influencing the distribution of wealth, power dynamics, politics, ability to lead and govern societies and the interconnectedness of societies.

Understanding the evolution of money through the lenses of Spiral Dynamics and Integral Theory equips C-Suite executives with a comprehensive map of the evolution of the global monetary system. By recognizing the patterns and shifts in values, behaviours, culture, and systems, leaders can better anticipate future developments and respond effectively to the ever-changing financial landscape. Embracing this integral approach allows executives to think through what may be coming and navigate the complexities of the global economy better and contribute proactively to the ongoing evolution of the monetary system.

Catalysts & Risks & Impacts

As the monetary system evolves through each layer, there are key catalysts that will impact the speed of the evolution and, risks, and impacts that may affect organisations and individuals. Understanding these factors is crucial for global leaders and C-Suite executives to be more able to respond effectively and maintain resilience in a dynamic financial landscape.

Catalysts for change by quadrant:

IT Technological innovations:

Artificial Intelligence (AI) and Quantum Computing, Web 3.0 and cryptocurrencies, are also driving the evolution of the monetary system. Organisations and individuals must adapt to these changes, leveraging new technologies to improve efficiency and access to financial resources.

AI, Web 3.0 and quantum computing: These cutting-edge technologies have the potential to revolutionise financial markets, risk management, and decision-making processes, offering unparalleled efficiency and insight for C-Suite executives.

Quantum computing: a cutting-edge technology that harnesses the principles of quantum mechanics, has the potential to revolutionise the global monetary system. The exponential increase in computing power provided by quantum computers will affect all aspects of the financial industry, with its impact felt across multiple stages of the monetary system's evolution.

Tokenisation and Programmable Money: Web 3.0 and cryptocurrencies will enable the tokenisation of various assets, including real estate, intellectual property, and even illiquid assets. This will create new financial markets, structures, instruments and investment opportunities, democratising access to previously exclusive markets. Furthermore, programmable money will enable the development of smart contracts that can automate complex financial transactions, increasing efficiency and reducing the risk of human error.

AI-driven Financial Systems: Web 3.0 will enable the development of advanced AI-driven financial services, such as personalised financial planning, risk management, and investment advice. These intelligent services will improve decision-making, optimise resource allocation, and drive innovation in the financial sector at all levels of governance.

I & WE Shifts in values and worldviews; individually (I) and collectively (We):

As individuals and societies progress through the stages of Spiral Dynamics and Integral Theory, values, and priorities change, affecting how we see, perceive and feel about money, value, and monetary systems.

Organisations must remain aware of these shifts to align their strategies with evolving cultural and social concerns, if they are to attract great people and for their products and services to appeal to their target audience, whilst satisfying their key stakeholders.

Trust: is a collective understanding, and any monetary system requires trust and faith, how that is provided depends on the stage of sophistication of the monetary system. The loss of trust in any important system is catastrophic for its survival.

A shift in cultural world view of significance can precipitate financial and power regime change. As the world grows angrier about wealth inequality and the consumption of resources and the destruction of the planets environmental balance and the risk it poses to humanity itself – prepare for the impetus for change to grow not quieten.

Politics & conflict: with shifts in culture come shifts in the balance of political power, wars breakout when the one side feels it has an advantage or nothing to lose as it is backed into a corner. Epochal shifts in the evolutions of monetary systems have often precipitated or followed major wars. I do not expect the current hegemony will give up its current privilege without a serious fight.

ITS Systems & environment:

The instant communication and interconnection of information and financial markets and increased cross-border trade have accelerated the evolution of monetary systems. Organisations must navigate complex regulatory environments, manage currency, liquidity and solvency and treasury risks, and adapt to the challenges of operating in a 24/7 instantaneously connected global economy.

Cross-border transactions and interoperability: Web 3.0 will improve the interoperability of financial systems, enabling seamless cross-border transactions and reducing the friction associated with currency exchange and international trade. This will contribute to a more interconnected and efficient global monetary system, promoting economic growth and development but simultaneously increasing the speed at which risks can materialise.

Systems Risk Management: Quantum computing will enable the development of more sophisticated risk management models and financial simulations. These advanced tools may help organisations better understand and mitigate potential risks, optimise investment strategies, and respond more effectively to market fluctuations. This improved understanding of complex financial systems will contribute to greater stability and resilience in the global monetary system. But watchouts will be whether anyone or group will be able to fully comprehend such a complex and fast-moving system.

Geopolitical Implications: The race for quantum supremacy may have significant geopolitical implications, as nations compete to harness the technology's potential for their financial systems. This could lead to rapidly changing power imbalances, with nations possessing advanced quantum computing capabilities potentially gaining an edge in global finance and economic influence. We have already seen the protection of rare earth resource availability for the key materials required to build such devices.

Climate change and power use: as the establishment battles to hold on to its regime against others including bitcoin the high-power usage narrative is often used to denigrate it benefits. This is a true and partial view as it ignores the vast power and resources used by the military industrial complex to protect the current monetary, governance and legal systems.

The ownership and chain of custody of your home is backed by the law, which is backed by the government, who in turn are backed by the military. The energy resources used to provide these necessary layers are invariably ignored when comparing the power use of monetary systems.

The Bitcoin network is uniquely capable of efficiently using previously geographically stranded renewable power sources to help sustain its distributed ledger of ownership. These renewable and cheap sources of previously untapped resources are being increasingly used whether they be hydro, solar, or waste product generated.

The anti-bitcoin narrative also overlooks the potential benefit for Bitcoin to provide mutually assured preservation thus allowing for greater dialogue and evolutionary development of nation states in a more peaceful environment. A classic green win:win.

Migration: with the ever-increasing risk of mass migration be it from, war, famine or climate change (and probably all three) then the ability to travel and access with a trusted secure store of the financial reserves built up in your life becomes vitally important. Notes or accounts in failed or destroyed nation states will be useless and bags of heavy precious metals are impracticable.

Interplanetary travel: as the opportunity for interplanetary travel becomes a focus and more possible then the ability to travel with a secure remotely accessible lightweight financial store becomes even more valuable.

Key risks to consider:

Regulatory and compliance risks: As monetary systems evolve; regulatory frameworks must adapt to ensure stability and protect consumers. We have seen that most regulatory systems (mostly blue in nature) are struggling to understand how they will manage the threat of the orange level (remember the GFC) let alone the green stage of distributed money like Bitcoin. Some nations have banned it – which have proved ineffective due to its distributed nature (green is more sophisticated than blue rules) and others have embraced it such as El Salvador. Organisations must stay informed about regulatory changes and maintain robust compliance programs to mitigate legal and financial and regulatory risks.

Cybersecurity threats: The digitisation of money and the rise of electronic banking with many third-party intermediaries have increased the risk of cyberattacks and data breaches and loss of value. Organisations and individuals must prioritise cybersecurity measures to protect their financial assets and sensitive information.

Quantum computing poses a significant threat to existing cryptographic systems, including those that underpin some cryptocurrencies and secure online transactions. Quantum computers are capable of breaking widely used cryptographic algorithms like RSA and ECC, potentially compromising the security of digital currencies and financial data. To counter this threat, the industry will need to adopt quantum-resistant cryptographic algorithms and security measures to ensure the continued safety and integrity of the global monetary system.

Bitcoin and other crypto still requires cyber security but does offer a distributed verifiable ledger to verify ownership and can also be held offline in cold storage.

Economic and market volatility and speed of response: The evolution of monetary systems can lead to periods of extreme economic uncertainty and market fluctuations. Organisations and individuals may prepare for potential financial disruptions by considering diversifying investments, maintaining adequate liquid reserves, and adopting flexible and more resilient strategies.

The current liquidity crisis seen playing out in some US regional banks (SVB) and the investment bank, Credit Suisse, were exacerbated by the Web 2.0 nature of instantaneous information sharing and online banking. We saw runs on banks executed in just a few hours from the comfort of people’s homes or offices – there is no need for a queue outside the bank anymore. Thus, feedback loops can be created in previously unimaginable speeds with potentially devasting impact.

Sovereign failure: What will happen if instead of losing trust and faith in a bank, people begin to lose faith in a sovereign nation and their currency? We have seen this happen many times in history and I fear we will see it again. The risks and consequences just get bigger.

We witnessed how quickly the resilience of the just-in-time global supply chain failed when ethnocentric needs for closing borders and keeping resources for health security prevailed in the recent pandemic.

If loss of faith and trust in a currency were to happen in a sovereign nation it is highly likely that capital controls will be put in place and instead of a supply chain issue when global trades halts for a pandemic – there will be a global liquidity issue, as capital flows are prevented from crossing borders. So how will you and your global organisation get ready and prepare if this scenario were to come to pass?

What reserves and where: If reserve currencies change, then so do what we hold in reserves, and where we hold them. What does this mean for sovereign bond markets? Mass volumes of outflows and inflows? Less liquidity, higher volatility?

What are the consequences for all the institutions, governments and pension investors that hold the bonds that go out of favour? The bond market is one of the biggest markets– so seismic shifts may have seismic consequences. Where will you hold your investments, pensions and treasury funds, in what with whom? Decisions must be made and proactively monitored.

An under developed leadership team poses significant risks when it comes to understanding and addressing the multifaceted challenges presented by the evolution of the global monetary system. If leaders do not have a comprehensive understanding of adult human development, integral theory, spiral dynamics, and the various technological, geopolitical, and socio-economic factors at play, then they may fail to adapt their organisations to the rapidly changing landscape.

Consequently, they risk falling behind in terms of innovation, competitiveness, and overall business performance. Furthermore, an inadequately prepared leadership team may struggle to make informed decisions and develop effective strategies, leaving their organisations vulnerable to unforeseen risks and unable to capitalise on emerging opportunities.

It is therefore crucial for leaders and their teams to vertically develop to enable them to build and maintain the sophistication required to manage these complex issues to ensure their organisations' long-term success.

Potential impacts of the evolution:

Changes in business models: The evolution of monetary systems may necessitate shifts in business models, as organisations adapt to new forms of currency, payment methods, and financial services. Entire business models will be obsolete and simultaneously new opportunities will be created. Companies must remain agile, embracing innovation, great strategic thinking, and continuous improvement to stay competitive.

Web 3.0 will have a profound impact on the global monetary system, enabling its evolution through the proliferation of decentralised finance, the adoption of digital currencies, enhanced data privacy and security, AI-driven financial services, improved cross-border transactions, and the tokenisation of assets. As the internet continues to evolve, C-Suite executives must remain vigilant and adapt to these emerging technologies to stay competitive and capitalise on the opportunities presented by the new era of the web.

To prepare for the impact of quantum computing on the global monetary system, C-Suite executives must invest in developing quality strategic thinking, research and development, stay informed about advancements in the field, and adapt their strategies to embrace emerging technologies. By doing so, they can mitigate potential risks, capitalise on new opportunities, and contribute to the ongoing evolution of the global monetary system.

Access to financial resources: As monetary systems evolve, access to financial resources may become more inclusive or exclusive, depending on the prevalent stage of development and your environment. Organisations and individuals must be aware of these dynamics to ensure they can access the necessary capital and financial services to support their needs and goals with resilient systems.

Redefining wealth and success: The progression through the stages of Spiral Dynamics and Integral Theory may lead to a redefinition of wealth and success, with an increased focus on social impact, sustainability, and holistic well-being. Organisations and individuals must align their values with these evolving priorities to maintain a positive reputation, attract talented people and foster long-term sustainable businesses.

By recognising the catalysts, risks, and impacts associated with the evolution of the monetary system, C-Suite executives can develop proactive strategies and make informed decisions that will allow their organisations to thrive in a dynamic socioeconomic financial landscape.

Embracing the future: A call to action

The evolution of money is an ongoing process, influenced by shifting values, technological advancements, and geopolitical and natural global phenomena. As C-Suite executives, embracing an integral understanding of the monetary system is vital for navigating the complexities of the global economy and contributing to its continued development.

By developing the ability to see and navigate multiple perspectives and by staying informed about the potential directions of monetary evolution and leveraging the insights provided by Spiral Dynamics and Integral Theory, leaders can ensure their organisations remain agile, adaptive, and ready for the future.

I urge you get more fully informed on the unfolding of the next stage of the evolution of the global reserve currency, consider all the potential catalysts, risks and impacts and get ready!

Disclaimer: This is not financial advice nor strategic advice, but an opinion piece written for education and information purposes only. Please do your own due diligence and get professional advice before making any decisions and taking any action or inaction. Seek appropriate professional advice before changing any strategy, investment or treasury approach or otherwise. Risks, implications, and opportunities may be different in different countries, markets, industries, legal, financial, tax and governance regimes.

All rights reserved Peter Dawson April 2023

Sources & suggested further reading:

Wilber, K. (2000). A Theory of Everything: An Integral Vision for Business, Politics, Science, and Spirituality. Shambhala Publications. (This book offers a comprehensive introduction to Integral Theory.)

Beck, D. E. (2007). Spiral Dynamics Integral

Jason P. Lowery (2023). SOFTWAR. A novel theory on power projection and the national significance of bitcoin. Massachusetts Institute of Technology.

The Endgame with Grant Williams, Bill Fleckenstein and Michael Kao EP:42

Super Terrific Happy Hour with Grant Williams & Stephanie Pomboy EP:17

Analysis: China role in Saudi, Iran deal a tricky test for U.S.

China's Xi calls for oil trade in yuan at Gulf summit in Riyadh

Saudi Aramco boosts China investment with two refinery deals

China buys more Iranian oil now than it did before sanctions, data shows

Ammous S (2018) The Bitcoin Standard the decentralised alternative to central banking

Watkins A & Wilber K (2015) Wicked & Wise: How to solve the worlds toughest problems

Cooke GC (2022) Web 3 The end of business as usual