Integral money: The evolution of the global monetary system and what we need next...

Mark Carney’s speech at Jackson Hole on Friday, August 23, 2019 was a watershed moment in global monetary history. He highlighted the need for the global monetary system to evolve. Many have been calling for this for years but for a current leader of a G7 central bank to do it, should make us all sit up and think through the impact.

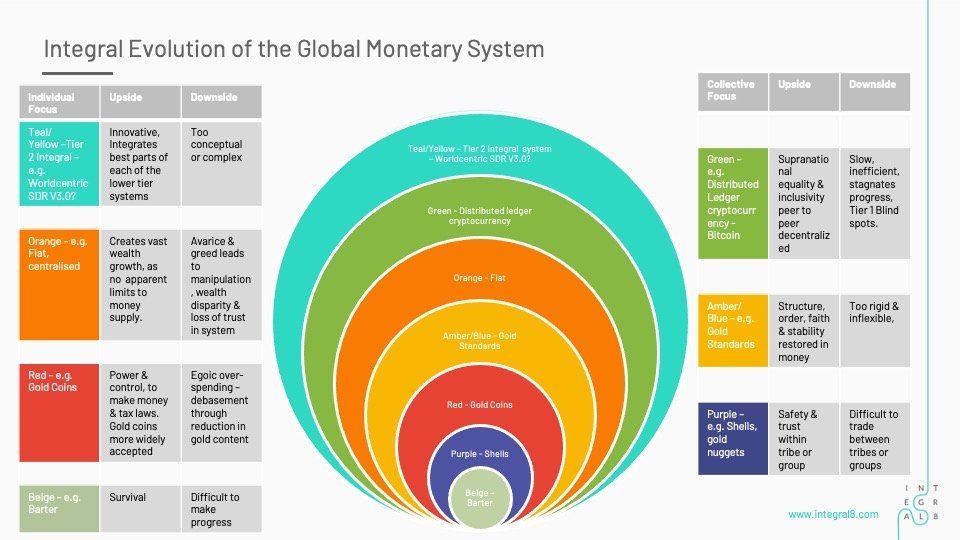

Most people don’t think about the global monetary system, it’s just money, right? Well the thing many pursue and measure success by, has been a variety of things over time. You may be surprised by what money currently is backed by and whom, and what it’s been in the past. Understanding this journey using an Integral frame and Spiral Dynamics gives us an insight into what we need to do next.

#Integral Theory is the powerfully enlightening meta-framework created by Ken Wilber who is probably the worlds current foremost meta level thinker. #SpiralDynamics which forms a small but important part of #IntegralTheory, is based on research done by Clare Graves on 30,000 plus people between the 1950’s and 1980’s and built on more recently by Don Beck.

Spiral Dynamics holds that there are currently 8 fundamentally different levels of value system that evolve, in precise order, vertically in a spiral. Each level transcends and includes the previous level and each level has an upside and a downside. It is the downside of each level that is the catalyst for the emergence of the upside of the next level. Every individual starts at the base and may (or may not) develop further up the spiral. Development cannot skip an evolutionary level. Each level is represented by a colour for ease of reference.

Both frameworks use vertical stages of evolution to describe and foretell distinct stages in the development of individuals, collective groups and systems.

I will use a shorthand description of these vertical stages for the purpose of this post to illuminate the evolution of money and its possible path forward. There is much more to this, than this simple summary, but I will hopefully give you just enough to give you a good sense of the reasoning and direction of flow.

Firstly, what is money?

Real Money is mostly understood as a:

Store of value or energy

Medium of exchange

Unit of account

Fungible (interchangeable)

Portable

Divisible

#Money is often differentiated from currency, as currency has all the above attributes except it does not always have the first (and most important) item on the list. As a currency’s worth tends to get debased or inflation erodes its value over time. A proper store of value would handle such conditions.

The first level of the #evolution is survival and represented by the colour Beige. It is individually focused and about immediate day to day survival. Currency coins and notes were not around at this point, so goods were exchanged directly for other goods. in a barter system, trade is slow and cumbersome, and it is difficult to get precisely what you need. You needed the exact goods the other person wanted to avoid a long trail of multiple trades and the risk your goods would spoil before you got what you needed. To make survival easier and to ease the flow of trade, people began to band together in small groups or tribes to share their goods and the next level of money began to arise.

The next level is known as belonging and is represented by the colour Purple. This level is focussed on the collective, in small groups or tribes. The groups are driven by belonging, safety and avoid risk. As trust built within the tribe or group, certain goods began to be used as early forms of money (anything rare, locally valuable or cherished that held some of the attributes of money). Examples of this included shells or bronze miniatures of goods, or gold nuggets. We still see these tribal/small group systems come into being in relatively modern-day world situations when groups are cut off from mainstream society, by war, or isolated by law. e.g. Cigarettes became tradeable currency in prisons or war time trenches.

#Gold began to be used by the Egyptians but was not yet coinage as we know it. The fact that it was rare (limited in supply), stable, didn’t corrode and had a low melting point made it stand out from other materials. Gold as a result of its low melting point is relatively easy to make into jewellery. Gold jewellery was worn at this level as way of keeping gold safe and with you at all times.

However, at this point they still used odd sizes, weights and purity. This made it difficult to trade effectively especially between different tribes or groups.

The next level is known as Power and is represented by the colour Red. Red is driven by individual power and control. It is directive and autocratic.

At the Red level money was backed by power and usually imposed by force! Many wars were fought throughout the globe and the spoils of war were, amongst other things, either gold itself or traded for gold.

If you have the power to make money, you have the power to make your own laws, and the power to influence government. A rarely discussed situation is that many central banks started out as privately-owned institutions (the US federal reserve bank still is!) created by very powerful business people, the icons of their time.

The Athenians used their power to make money and laws to impose a tax system. This tax needed to be paid and thus gold coins of a certain weight and purity were produced to pay it.

If you had the power, you made the coins and you set the standards for the coins production. The coinage was made of actual gold and silver, the weight, size, shape and purity were set at certain levels for certain coins.

The Romans used gold and silver coins to pay their armies, as it was seen and accepted as money across many countries and cultures who had also discovered its benefits under the purple level.

If they lost their power through losing battles and lost access to their goldmines, they lost their ability to create money. In an attempt to spread their power, Red leaders often overspent on wars or great buildings to aggrandise their importance. If this spending was ultimately beyond government receipts (deficit spending) then it began to deplete reserves.

The downside of red came as reserves were depleted, the purity of the gold in coins was reduced and the money debased. Coins of a certain face value were often clipped or as the powerful body overstretched its finances it simply made coins of lower gold and silver content by mixing it with more and more copper.

According to Gresham’s law, bad money pushes good money out of circulation. As people retain the good and spend the lesser quality coins as fast as they can.

As the debased money pushed out the quality money, next level emerged and the upside of the level known as Order and represented by the colour blue or amber came into being, introducing some order, rules and structure.

Blue (or amber) - this level is focused on the collective again and brings, order stability and process. This level likes to do the right things in the right way, with rules and structure paramount. Gold standards were introduced my many countries where their currencies (now made of paper) were literally a claim check redeemable at the central bank for a specified amount of gold at a fixed price. This system initially overcame the clipping and debasement issues and faith in money was restored.

The way these standards were structured were relatively rigid and made increasing the money supply difficult. Thus, Governments had to live within their means, and not spending is often not popular with voters. Thus, when governments overspent and overborrowed on public services or creating or defending wars, there would be a draw down on the underlying gold and the currency would rapidly approach failure. This was sometimes temporarily overcome by repricing the gold standard to reflect the increase in money supply. When this was not done appropriately massive deflation and depressions would occur or be extended, such as in the UK post the first World War.

The pressure increased for a broader solution to the debt, reserves and trade imbalance problems created by World War 2 which led to the famous meeting at the Mount Washington Hotel, Bretton Woods that created the eponymous monetary system, The International Monetary Fund (IMF) and the IBRD now part of the World Bank. This system placed the dollar as the reserve currency for other major currencies to peg against and the dollar itself was then backed by gold at a fixed price. At the time the US central bank had by far the largest gold reserves. In this system the Dollar was deemed “as good as gold”.

Despite its advances over the previous individual standards the Bretton Woods system was also too rigid and did not create enough flexibility to increase money supply, so when the US began overspending on war and public programmes, France ,amongst others, sought to enforce the convertibility of its US Dollar currency reserves into gold.

With US gold reserves depleting one Sunday night in 1971 the Orange monetary system burst into life when President Nixon announced it was to break the Blue rules with its “temporary suspension” of the gold convertibility of the US dollar. By that announcement the reserve currency of the world became fiat, as effectively did all those previously pegged to the dollar.

The Orange level known as Wealth is where people focus on winning and succeeding, and for Oranges to win there must be a loser. They love to achieve their goals. They are pragmatic, deliverers and are great at building wealth. They are happy to adapt the blue rules to reach their objective. They want to be seen to succeed and be wealthy and at the extremes or downside will do anything to achieve their goal and receive their reward.

With the arrival of a fiat reserve currency - backed by seemingly nothing - the store of value aspect of money as has been diluted/removed. This started with Nixon in 1971 and the collapse of the Bretton woods system and fiat continues to be our dominant system of money today.

As part of the Bretton Woods system the IMF created the Special Drawing Rights (SDR) as a global reserve asset for use between IMF and the Central Banks. The value of the SDR is itself based on a basket of other currencies (USD, Euro, Yen & GBP). The SDR was arguably intended as worldcentric - but access was limited to the 4 most powerful economies of the time. Membership was expanded to 5 members with the inclusion of China and the Yuan, CNY on 1/10/2016. The IMF massively increased the issuance of SDR’s to help Central banks out during the 2008/9 Global Financial crisis. The SDR was initially defined as equivalent to 0.888671 grams of fine gold (at one point the same as the US dollar) but today the SDR is just another claim check backed by other fiat currencies. The IMF does however like most Central Banks hold large Gold reserves but offers no convertibility.

Globally no currency is currently officially pegged to gold or backed by anything although central banks still are the largest holders of gold known in the world.

In a classic Orange market manoeuvre, to keep up the demand for the fiat US Dollar reserve currency the US persuaded the Saudi’s to price their vast oil exports in the US Dollar so that other nations needing the oil, would need to acquire US Dollars first. In return the US offered the Saudi’s the support of their vast military power. The Petrodollar was a successful orange market operation that was achieved through the offer of red power to bring Saudi into the US blue ethnocentric group of protection.

Whenever the dominance of the Fiat reserve currency is threatened, conflict often follows fast, either through sanctions, a trade war, a currency war and ultimately, a kinetic war. Read the recent history of the fate of nations or leaders, threatening to use currencies other than the reserve currency to price their oil exports.

The downside of Orange was seen during and post the 2008 Global Financial Crisis, central banks have issued massive quantities of new currency (given the obfuscating title of Quantitative Easing or QE). Increasing the currency supply to never before seen levels. This has caused huge asset value inflation across the world, making the wealth gap enormous, which has led to populist uprisings around the globe. As people no longer accept the situation of their currency (they call money) being debased by QE.

Some Governments and central Banks arguably manage the level of stated inflation by changing the way it is calculated to ensure that the easing can continue. A classic Orange manoeuvre. In another classic Orange manoeuvre, the populous at large in the western developed world have been persuaded that inflation is a good thing, not realising it is effectively a transfer of wealth from them to the creators of money (e.g. a kind of tax on savings).

All previous fiat currencies in history have failed. In a repeat of the well-trodden path, globally fiat currency is exchanged for real assets or goods. For years now many central banks and nations have been in a race to see whom can gain control of as many real assets as possible in exchange for their fiat currency. Dollar reserves have been used to acquire vast infrastructure and real estate. Even the Swiss Central Bank issued currency (QE) and used it to buy Apple Stock amongst other things!

There is growing support for #ModernMonetaryTheory (#MMT) or “peoples QE”. This in my opinion, is another extreme orange manoeuvre albeit with a Green social purpose (more on this in a moment) but with a massive blind spot. As with all QE, whatever it’s short term purpose, will just accelerate the downside of debasement we are already experiencing. Whilst the rationale seems well placed, it is, as with all perspectives partial and is failing to acknowledge the long-term consequences of such action. As is the nature of the Orange value system.

So, if money is backed by nothing and people wake up to this en masse - confidence in the system will be increasingly broken; quickly and deeply.

And with Judy Shelton, a sound money proponent, recently appointed to the board of US Federal Reserve Bank, the opportunity for change to the current system is building.

So, what next, we don’t need more Dollar hegemony as Bank of England Governor Mark Carney points out, but do we need another privately owned version thereof or something else entirely?

At each inflection point we have the choice to evolve and emerge to the next level or fall back and hope that if we revert to an old system it will work. History tells us repeatedly that reverting to a lower order global monetary system on its own does not work, for all the reasons it failed before and a few more.

So, as the downside of Orange becomes more prevalent this brings the opportunity to emerge to the next level of the spiral, Social, represented by the colour Green. This is a level focused on the collective and seeking a win-win, a kinder, fairer and more inclusive system.

Green is not just concerned with a small group, or a large ethnocentric group but takes a worldcentric view. It wants a sustainable system that includes and treats all equally around the world. For this to happen we need a system that can share the power, the wealth and a monetary system that works for the poor nations and the rich nations and finds a way to enable the equalisation of the disparity. If measured by only money this may be doomed to fail.

We need to find a way to build the trust and confidence of the people in the system. A fairer and more inclusive system is what the Green level is seeking. The Greens are seeking a system that is based on trust that can be verified independently and cannot be unduly influenced by any factions of power for their own gain.

The downside of the Green level is that in its pursuit for total equality, it is against all hierarchies as they see them as oppressive. They fail to see their own blind spot, that this view in and of itself, is a hierarchy – i.e. equality is better than hierarchy; is a hierarchy!

They also fail to differentiate dominator hierarchies from growth hierarchies. This means they fail to appreciate the value of evolutionary growth hierarchies (or holarchies). Words don’t dominate letters any more than sentences dominate words. But one transcends and includes the other and in turn is more sophisticated and can be more useful in certain situations. This sort of growth hierarchy is dismissed by the extreme greens, as they reject all claims of one thing being better than another. In their quest to keep things equal they end up in a position where there is no truth, as no one view is more valuable than another. This is a serious barrier to solving complex problems, verifying transactions and proving individual ownership!

Peer-to-peer, distributed ledger cryptocurrencies – specifically #Bitcoin may hold part of the answer. The fact that it is a system not owned by anyone, with a distributed verifiable ledger is a positive from the Green perspective.

Bitcoin's innovation is that its system has solved the Byzantine Generals Problem i.e. the ability to reach an agreed truth across a network, even if some of the participants are unreliable. Dan Tapiero, a renowned global macro investor, refers to Bitcoin as a great invention and as a “digital truth machine” and truth is definitely needed in our Green, post truth world.

Bitcoin's energy needs and limits on the number of transactions it can process per second means it may be part of the answer but not all. The concentrated ownership of existing Bitcoin may also prove to be a stumbling block for the Green value system.

There are many new payment systems and digital currencies being used or proposed in the world today e.g. Aadhaar in India or Libra, but as a client said to me recently “the tech is important, but it’s not the whole answer, it’s how we use the tech, that will be critical to the success of the solution”.

#Libra is a proposed privately owned supranational digital payment system and currency that itself is based on a basket of fiat currencies. It is essentially an Orange system with some Green attributes. The opportunities presented by a potential 2 billion users may ultimately be too massive to resist, for the Orange system not to out manoeuvre the Blue regulation that will be attempting to control it. Any controls from a Blue level will eventually prove futile in the face of the huge rewards made possible by such an Orange system. Data privacy and its protection is a huge barrier to overcome successfully.

A new Green global monetary system needs to be truly supranational, open source and more inclusive by design and beyond private ownership, influence and control.

The major challenge in arriving at a new global monetary system is that each of the first 6 levels of the spiral (Beige to Green, collectively known as Tier 1) are absolutely convinced that their view of the solution is the right answer and all others are wrong. You don’t need to spend more than 15 minutes on social media to see how strongly held the views of each level are held, supported and defended (note to self!).

This is where the quantum leap is taken into the first level of #Tier2. This level is known as either Integral or Innovation is represented by the colour Teal or Yellow. This level is the first level that can see that each level beneath, may have a part of the answer but not the whole answer. This level also takes personal responsibility, in that it recognises it may be part of the problem. But this level is optimistic, innovative and brilliant at building the future.

At this level it seeks to gain the best of the ideas from the other levels and integrate them into a system that can handle the complexities for the global economy today and the foreseeable future. Its ability to see multiple perspectives means it can handle enormous volatility, uncertainty, complexity and ambiguity. We definitely need a system that can do this, to avoid repeating or escalating the suffering created by the previous financial meltdown.

Teal/Yellow is not the final level in the system either and will of course have downsides ultimately, but it is the first level that will seek to innovate a solution, using the best of what we know, to create something we have never seen, but desperately need.

I do not know the final answer, but I can see the direction we need to take given the brilliant Integral framework.

Maybe it’s a distributed ownership, #worldcentric, globally inclusive SDR V3.0, including a Gold base component and a distributed ledger truth machine, with appropriate protocols, data security and #Crowdocratic governance. Maybe it incorporates all of these aspects, maybe it’s none of them and is something entirely new.

In order to reach the point of implementing any solution, we will need a form of #Crowdocracy, a new decision making process that can manage the complexities and empower the governing system at the appropriate level to make the decisions required.

But we are not at Tier 2 yet in the global monetary system, as we have yet to experience the full upside and downside of the Green level system and evolution cannot skip a step, if it is to develop healthily.

In this note I am only considering a narrow view of the #GlobalMonetarySystem and using the briefest description of part of the Integral framework. Hence, I accept it is just a partial view and a more #AQAL Integral approach is required to look at this problem in more ways and from more perspectives.

I offer this note only as my opinion of a different way of looking at the evolution of the global monetary system, with the intent that it may help those actively involved in such systems to look at things from another perspective and maybe help move them closer to a more Integral sustainable solution.

We aren’t there yet, but the pieces are coming into sight, let’s make sure we evolve upward and not move sideways or down and avoid repeating the mistakes of the past.

The best way for each of us to help and the fastest way to find a solution, is to work on our own #VerticalDevelopment journey and to progress up through the evolutionary levels, sharing our thoughts, learnings and insights with each other as we travel.

Any global monetary system reset will affect all of us, and the way we live, for generations - We need the finest Integrally informed people to combine with the finest minds in economics, banking & finance, geo-politics, network analytics, social & cultural evolution, governance, tech and systemic thinking to create a sustainable integrated solution.

Together we will find a better answer. Together we will find a more whole, less partial solution. Please do your part by helping this message reach the people that can make that happen.

I would love to hear your views on the way forward.

Thank you for your time.

References and recommended reading/viewing:

A Theory of Everything - Ken Wilber

Trump and a Post Truth World – Ken Wilber

Spiral Dynamics Integral – Don Beck

Crowdocracy: (The End of Politics) (Wicked &Wise) – Dr Alan Watkins & Iman Stratenus